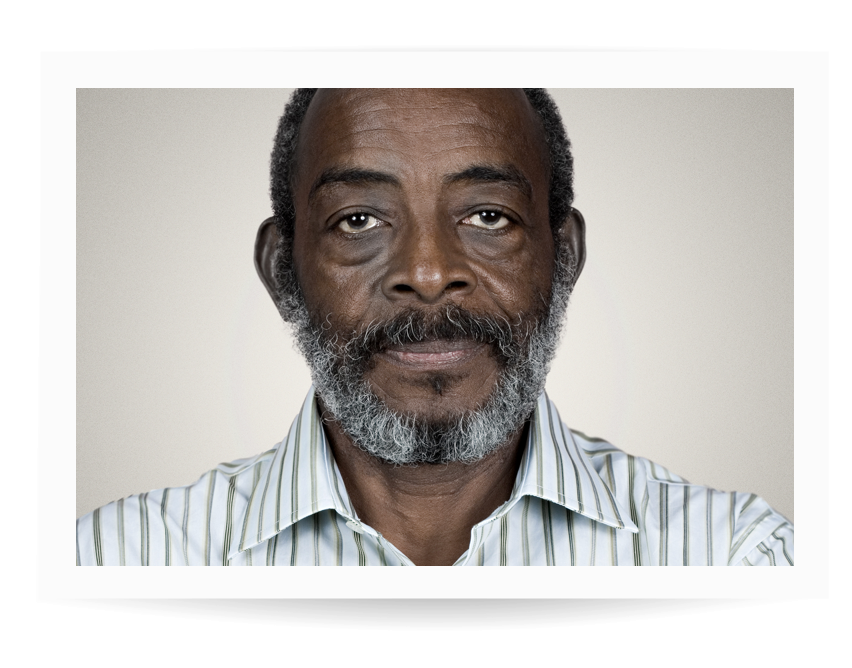

BEMBE DOESN’T NEED IMMEDIATE

TREATMENT SO HIS POLICY WON’T

MAKE AN IMMEDIATE PAYOUT

Fortunately, Bembe’s prostate cancer is low grade, so his Consultant just wants to keep him under observation for the time being. But…

Bembe’s critical illness policy won’t pay out. Apparently, his cancer isn’t critical enough because he doesn’t need immediate treatment or surgery.

So, Bembe’s now facing an uncertain future. He’s not sure if or when he’ll need treatment and if or when his policy will pay out.

Bembe is not alone