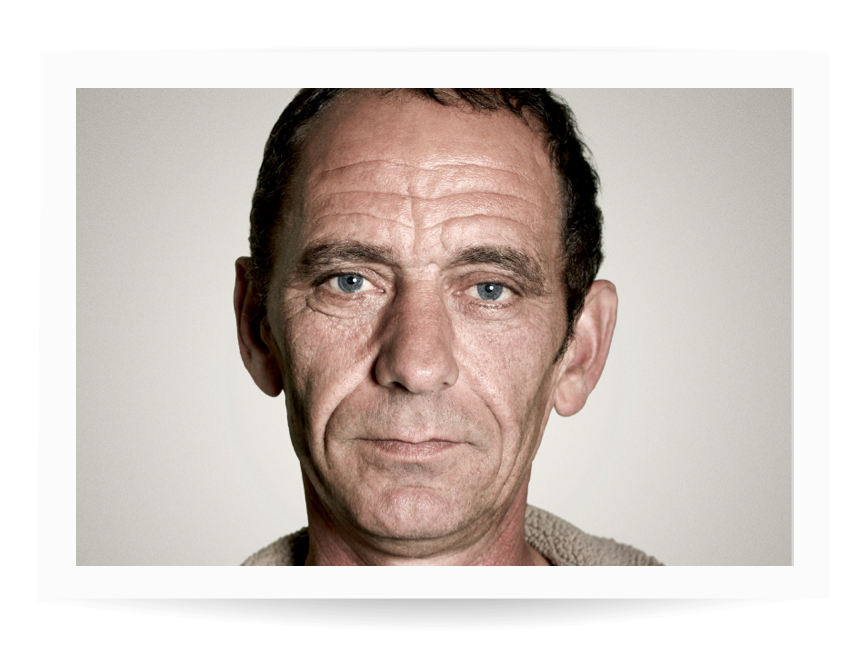

COMPANY CUT BACKS COST JO HER

JOB AND HER CRITICAL

ILLNESS COVER

Jo lost her job as a chef 3 months ago. Her redundancy money has run out and the struggling economy has made finding a new opportunity impossible.

Money is now so tight that Jo’s been forced to cancel the critical illness policy she’s had for 10 years.

Jo plans to take out cover again when she’s back on her feet. But doesn’t yet realise that insuring herself again in the future will be much more expensive because she’s 10 years older.

Jo is not alone